Capital Allocation Online Education

Unlock the door to enhanced capital allocation and value creation with our unique online education

Our e-learning program adopts a practical, market-oriented

approach to capital allocation. It demystifies this complex topic and

focuses on creating real shareholder value. The course features numerous

case studies and engaging pedagogical exercises, ensuring you

gain hands-on experience and valuable insights. The programme consists of four modules.

Read more about the content of the programme (pdf) and make a non-binding registration here.

Online course - Introduction

This online course takes a practical approach to help you understand how to use the information provided by the market as input in your capital allocation process. We will discuss how to analyse market data and use it to evaluate potential investment opportunities, and how to balance theoretical frameworks with real-world insights.

There are low hanging fruits for both corporate executives as well as for investors that know the inside out of capital allocation.

Programme Structure

The structure of the programme will to a large degree follow the outlay of the book “Capital allocation and value creation – A market based framework for executives”.

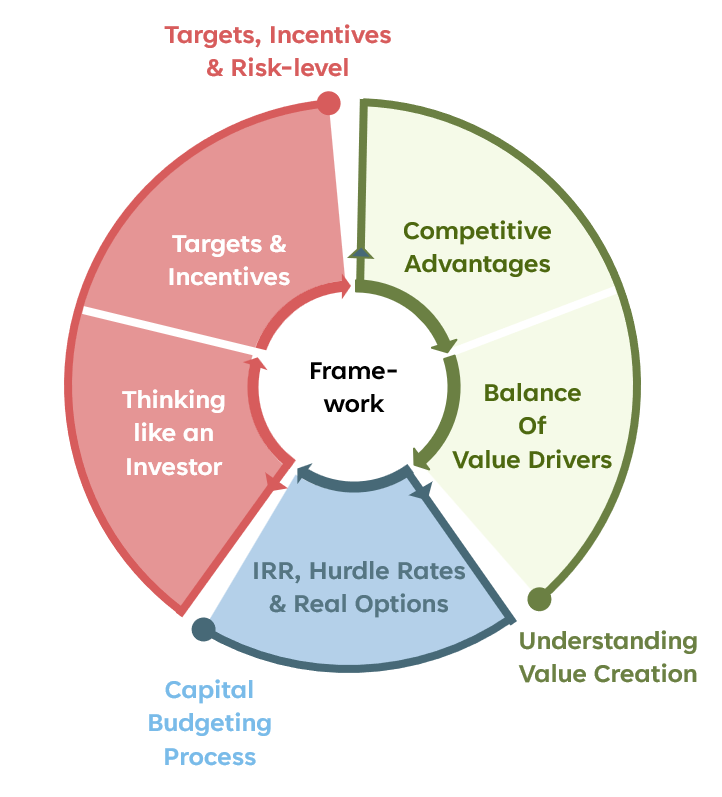

The programme consists of four modules with e-learning materials such as videos, excercises and case-studies.

Module 1. The value framework

Module 2. Cash flow deployment alternatives

Module 3. Reading the market and thinking like an investor!

Module 4. The capital allocation framework

Endorsements:

Anders Borg, Chairman LKAB

"Torbjörn's book provides a great framework for thinking about Capital Allocation"

Johan Dufvenmark, CFO Beijer Alma

"The best practitioners’ guide to capital allocation!"

Göran Björkman, CEO Alleima

"The book provides a clear and pedagogically effective way to understand of capital allocation."

Christian Sievert, Board Member, H&M

"Torbjörn's book presents a straightforward and effective framework for understanding capital allocation"

Elisabeth Mosséen, GT SKF

"Torbjörn explains in an educational way and through many practical examples how CEOs and CFOs can make long-term decisions that lead to value creation in companies. His book 'Capital Allocation and Value Creation' contains many valuable insights that I have been able to apply in my discussions with management."

Jörgen Rosengren, CEO Gränges

"Torbjörn has written an excellent and accessible book on the sometimes difficult-to-grasp subject of capital allocation."

Per Frennberg, Chairman AP7

"The book deals with the important topics of optimal capital allocation and creation of value, from both a theoretical and practical perspective. It is generously illustrated with relevant empirical examples. Highly recommended reading for corporate executives, board members as well as investors and investment analysts."

Jörgen Elf, Group Treasurer SCA

"Over the past few years, there have been several occasions when there has been a need for qualified analyses of capital structure and rating issues. Torbjörn has always been the one who provided the most qualified analyses and delivered well beyond expectations. A brilliant analyst with deep insights and expertise in financial matters."

Pår-Ola Wirenind, Group Treasurer

"As a Group Treasurer, I truly appreciate Torbjörn's approach to financial strategy. He has a clear ability to link the company's business strategy to key decisions around capital structure and funding"

John Bäckman, Head of IR & Treasury Mat as A/S and formerly Pandora

"This book is an invaluable resource for Investor Relations professionals seeking to bridge the gap between a company's business strategy and the investors' perspective on value creation. It offers clear, concise insights and will greatly benefit any IR department looking to enhance its communication with the financial market."

Patrik Juhlin, Group Treasurer Sandvik

"Torbjörn’s approach to capital allocation provides valuable insights into aligning financial strategies with business objectives. He emphasizes the importance of understanding the company’s business model and market dynamics to make informed decisions, enabling a treasurer to optimize funding structures and effectively manage risks."

Eva Gotthardsson, Group Treasurer Lantmännen

"Capital allocation plays a critical role in driving success. This book offers an easy-to-understand market-based framework that demystifies complex financial concepts.."

Magnus Jonasson, Head of Asset Allocation, AMF Asset Management

"Having spent my entire career in asset management, I’ve come to recognize one of the most critical drivers of long-term returns: effective capital allocation—both at the portfolio level and within a business. This insightful book serves as an essential guide, where the author blends rigorous analysis with practical wisdom, offering invaluable insights for executives, investors, and anyone looking to understand how intelligent capital deployment fuels long-term value creation. A must-read on the art and science of capital allocation."

Magnus Söderlind, CEO Bergman & Beving

"Capital Allocation and Value Creation is an excellent read for corporate decision-makers!

Dan Christiernsson, Senior Portfolio Manager, Alecta Tjänstepension Ömsesidigt

"Written by a highly experienced practitioner, this book provides an insightful guide to key topics in capital allocation and value creation within a company, blending both theoretical and practical perspectives. It is highly recommended for anyone looking to enhance their skills in this field, from corporate executives and investors to students"

Non-binding registration to the Executive Education Programme

Behind the Programme

Main responsible:

Torbjörn Arenbo